“The global fintech market was valued at US $340.10 billion in 2024 and is projected to reach US $1,126.64 billion by 2032, according to projections based on Statista data.”

Have you ever wondered how certain apps allow you to receive cash immediately, without credit checks, without any paperwork, and simply with a few taps? It is the magic behind Cash Advance Apps, a fintech startup that is changing the way people access money. These applications merge risk analysis powered by AI, an uninterrupted user experience, and bank-level security to provide quick and stress-free advances.

With the changing financial behavior, the companies and investors are posing the question: what makes the best cash advance apps so effective, and how can we create one?

This guide reveals their operation, the aspects that made them successful, and how the development of a fintech app can help you build a next-gen platform like Earnin, Dave, and Brigit.

Understanding Cash Advance Apps and Their Market Rise

The demand for cash advance apps has increased sharply, which indicates a change in the behavior of users. Contemporary consumers are more flexible and visible and need access to real-time financial services. These applications enable individuals to get part of their future salary prior to payday to help them fill temporary financial gaps.

Statista forecasts that the fintech market in the world will have crossed over $305 billion by 2025, and a significant portion of that increase is also due to mobile-first lending solutions. This shows enormous opportunities for businesses that invest in the development of Fintech Apps to develop their own customized platforms to meet this increasing demand.

How the Best Cash Advance Apps Work

In order to see the potential of the best cash advance apps, it is necessary to understand the working model of these apps. The applications combine a variety of technologies, among which are AI-powered credit scoring, open banking API, and automated payment systems.

1. User Registration and Verification

It starts with secure onboarding with the help of Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Identity checking API integration can guarantee compliance and minimize fraud.

2. Income Verification

Apps are linked to the open banking API of the user’s payroll or bank accounts to evaluate income frequency and the history of transactions. This facilitates advanced eligibility real-time decision-making.

3. Instant Fund Disbursement

On approval, customers would be able to get advances instantly through connected bank accounts or e-wallets. These transactions are run through automated clearing house (ACH) systems or rails of instant payment.

4. Smart Repayment Mechanisms

The repayments are automatically planned on the following day of payment. The automation minimizes the risk of default and increases the trust of the users.

Simply put, the systems are a creation of the intersection between mobile app development and financial intelligence, which provides efforts in developing a smooth and individual borrowing experience.

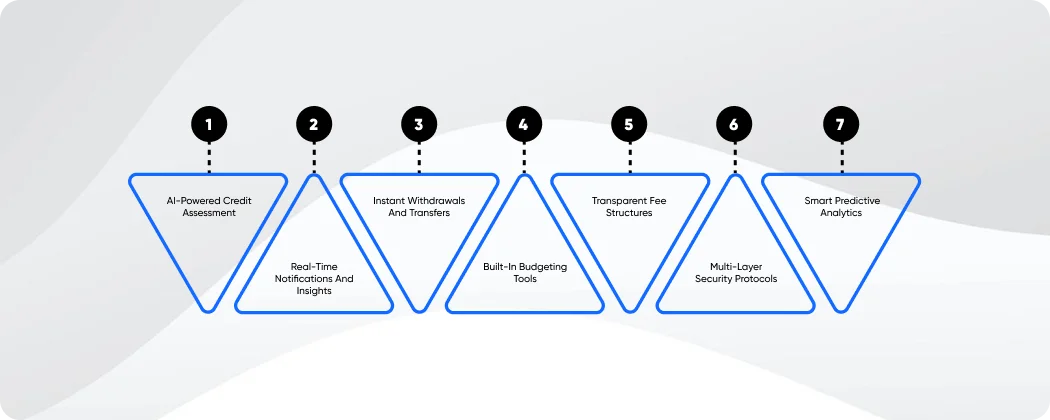

Top Features That Define the Best Cash Advance Apps

The mix of user-friendly and advanced technical features should be considered in your Fintech app development strategy in order to compete with the best-performing platforms. The following are the necessities:

1. AI-Powered Credit Assessment

In contrast to conventional credit scores, AI-powered models use alternative data points like spending behavior, income reliability, and transaction history to conclude that a person is eligible to take a loan.

2. Real-Time Notifications and Insights

Push notifications remind users of the balance they have, repayment due dates, and their spending behavior to stay engaged and financially conscious.

3. Instant Withdrawals and Transfers

Major applications provide the transfer of funds into the wallets or debit cards immediately, saving the waiting period and making the users more satisfied.

4. Built-In Budgeting Tools

Most of the best cash advance apps are also combined with expense tracking and budgeting applications, and they can allow users to manage money better than cash advances.

5. Transparent Fee Structures

Transparency is a concern for modern-day users. Applications such as Dave and Earnin do not have to deal with hidden charges; instead, they work based on tips or other minor membership charges.

6. Multi-Layer Security Protocols

Inclusion of end-to-end encryption, biometric authentication, and tokenized transactions is a requirement of all serious Fintech app development endeavors in order to win the confidence of users.

7. Smart Predictive Analytics

Predictive analytics will be able to predict user cash and spending habits to enable apps to recommend when an advance is needed or when there is a risk of overdraft.

Market Leaders in the Cash Advance Space

Watching other current leaders assists in sharpening your roadmap. The following are the standards of the most successful cash advance apps in the market:

1. Earnin

Earnin was the first of its kind in revolutionizing short-term lending by providing cash advances without charging any customary fees or interest rates. Financial flexibility encourages the user to access up to $750, depending on the amount earned by the user. The smart application is smart enough to use geolocation to keep track of work hours and AI-based algorithms to show the reliability of income to ensure responsible lending.

Key Features:

- No-Interest Model: Users pay voluntarily through tips instead of interest.

- Work Hours Tracking: Uses GPS to confirm job attendance.

- Instant Fund Access: Quick disbursement directly to linked bank accounts.

- Balance Shield Alerts: Prevents overdrafts by monitoring account balances.

- Financial Health Insights: Provides spending summaries and cash flow analytics.

2. Dave

Dave is concerned with enhancing the financial well-being of users through cash advances, spending plans, and overdraft coverage. The app is unique, as it enables people to escape charges and develop superior financial behaviors. It also grants credit-building, which offers both short-term relief and long-term financial development to users, which is based on transparent digital banking.

Key Features:

- Instant Cash Advances: Offers up to $500 before payday.

- Automatic Budgeting: Tracks spending and categorizes expenses.

- Overdraft Protection: Prevents overdraft fees with predictive insights.

- Credit-Building Account: Helps users improve credit scores over time.

- Goal-Based Savings: Enables users to create and manage savings targets easily.

3. Brigit

Brigit achieves empowerment by balancing machine learning and real-time data analysis to offer its users proactive management of financial data. It analyzes spending habits, forecasts possible overdrafts, and makes instant advances where necessary. In addition to lending, Brigit provides educational financial guidance so that users can make smarter financial choices and be financially secure in the long term.

Key Features:

- AI-Powered Financial Tracking: Monitors cash flow to prevent overdrafts.

- Automatic Cash Advances: Send funds before the balance drops below zero.

- Financial Insights Dashboard: Provides personalized budgeting guidance.

- Credit Protection: Offers credit monitoring and improvement tips.

- Spending Alerts: Notifies users of potential budget issues early.

4. MoneyLion

The financial ecosystem provided by MoneyLion is where cash advances, credit monitoring, investing, and banking are all available within a single application. Its holistic nature assists users in developing wealth, controlling expenses, and enhancing creditworthiness at the same time. Its tailored financial advice and free interest cash advances enable users to have full control of their financial experience.

Key Features:

- Integrated Banking: Offers checking accounts with no hidden fees.

- Investment Options: Allows automated investing with low minimums.

- Credit Monitoring: Tracks and improves credit health.

- Instant Cash Advances: Provides quick access to earned wages.

- Rewards Program: Encourages healthy financial behavior through loyalty incentives.

These instances demonstrate that winning apps do not merely offer money but create spaces around financial health and transparency.

Why Building a Custom Cash Advance App Is a Smart Move

The success of the best cash advance apps is an indication that there is a profitable venture in the business planning to venture into the fintech field. Developing a cash advance application results in you being able to:

- Target niche markets like freelancers or gig workers.

- Offer flexible lending products tailored to income cycles.

- Build a recurring revenue model via memberships, commissions, or premium analytics.

- Leverage brand trust through transparent, tech-driven services.

By developing a proper Fintech app development strategy in mind, you will be able to get a feel for the best in the market and keep your own brand voice.

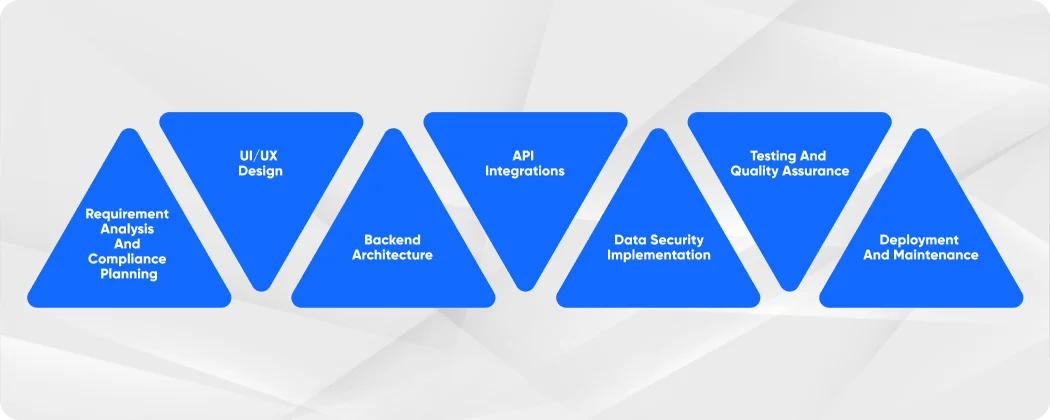

Technical Roadmap for Building a Cash Advance App

Designing the best cash advance site demands excellent knowledge in the field of technology and finance. The process of Fintech app development will look as follows:

1. Requirement Analysis and Compliance Planning

Every fintech product should comply with the regulations like GDPR, PCI DSS, and domestic financial regulations. The compliance planning at an early stage prevents expensive revisions in the future.

2. UI/UX Design

User experience is key. An interface with no friction enhances retention. Apply data-based design tools to make it intuitive and mobile-friendly.

3. Backend Architecture

Scalability is critical. Real-time processing, API, and data security are made available by cloud infrastructure (as in AWS or Google Cloud). Use microservices to have scalability of modules.

4. API Integrations

- Banking APIs for account linking and payments.

- Identity APIs for KYC/AML verification.

- Credit scoring APIs for financial analysis.

- Notification APIs for engagement.

5. Data Security Implementation

Encrypt transactions and user credentials with AES-256 encryption, use of SSL, and OAuth 2.0.

6. Testing and Quality Assurance

Test manually and automatically on gadgets to make sure that there are no errors in the performance. Add penetration testing to test the resiliency of the system.

7. Deployment and Maintenance

Once launched, work on the constant updates, bug fix treatment, and feature improvement. Frequent audits are used to check compliance and security.

Cost Factors in Cash Advance App Development

Understanding the price of developing a cash advance app can make you think about the future and distribute the funds wisely. There are some major determinants of the general pricing, which are as follows:

- Type of mobile app development framework (native or cross-platform)

- Number of integrations and APIs required

- Security and compliance standards implemented

- Design complexity and scalability goals

| App Type | Estimated Cost | Description |

|

Basic MVP |

$40,000–$80,000 |

Includes core features like login, cash advance, and repayment functionality. |

|

Mid-Level App |

$80,000–$150,000 |

Adds AI-based analytics, payment gateways, and improved UX/UI. |

|

Full-Featured App |

$150,000–$300,000+ |

Enterprise-grade solution with multi-layer security, scalability, and integrations. |

By hiring an experienced enterprise app development firm, the company can save on expenditure without compromising quality standards and regulatory standards due to agile practices and incremental development.

Challenges in Building a Cash Advance App

Even superior cash advance applications have challenges in the industry. The preparedness of these is a way of reducing risks.

1. Regulatory Compliance

The fintech is also highly regulated. You should also obey the banking laws as well as the consumer laws. Collaborating with legal and compliance professionals is a way of having your app run amicably.

2. Risk Management

One of the significant issues is credit risk. Apply AI models and predictive analytics to evaluate the creditworthiness and eliminate defaults.

3. Data Privacy and Security

Anonymization and strong encryption measures should be employed since the user data is sensitive. The compliance with privacy regulations, such as GDPR, creates user confidence.

4. User Trust and Transparency

Everything in fintech is about trust. The disclosure of clear fees, quick customer service, and regular customer education establishes long-term relationships.

Monetization Strategies for Cash Advance Apps

A vigorous revenue structure must be developed so that it becomes sustainable. The optimal cash advance apps are based on several streams, including:

- Subscription Plans: Premium users get higher limits or faster transfers.

- Tipping Models: Users voluntarily pay service tips instead of interest.

- Affiliate Marketing: Partnerships with banks or budgeting tools.

- Credit Building Add-ons: Paid features for credit score improvement.

When you position your monetization model in line with user value, you are making a user-friendly and profitable business.

Future Trends in Cash Advance App Development

With the active development of the fintech ecosystem, several technological trends are bound to influence the new generation of apps:

- AI and Predictive Analytics: For hyper-personalized lending and financial recommendations.

- Blockchain Integration: Enabling transparent, tamper-proof transaction histories.

- Embedded Finance: Seamlessly integrating financial services into non-financial platforms.

- Biometric Authentication: For enhanced identity protection.

- Gamification: Engaging users through reward systems and progress tracking.

These advancements will not only redefine the user experience but also increase the level of confidence and effectiveness in the development of Fintech apps.

“At 8ration, our focus is on merging cutting-edge technology with trust. With advanced fintech app development, we aim to create platforms that not only provide cash advances but also guide users toward better financial wellness.”

– Muzamil Liaqat Rao, CEO, 8ration.

Building the Next Market-Leading Fintech App

The emergence of the best cash advance apps demonstrates the changing nature of personal finance with the use of technology, providing speed, transparency, and empowerment. To businesses, creating a bespoke cash advance application is a good opportunity to venture into the rising field of fintech.

You can develop a solution and compete with the very best in the market with the appropriate combination of Fintech, mobile, and enterprise app development expertise. Finally, it is a success that is achieved through the combination of technology and trust to provide smooth access to finance.