The global mobile banking market was valued at about USD 1.87 trillion in 2025, and is projected to grow at a compound annual growth rate (CAGR) of ~16.8% through 2033, reaching a potential valuation of USD 6.4 trillion+.

Remember when banking meant waiting in endless queues? Those days are gone. Today, over 2.5 billion people manage their finances through smartphones, and that number is skyrocketing. The best mobile banking apps have revolutionized financial management, turning complex transactions into simple taps.

Whether you’re building the next fintech unicorn or choosing your banking platform, this list best mobile banking apps reveals what separates industry leaders from the rest. We’ll dissect the digital banking apps dominating 2025, uncovering their security frameworks, UX strategies, and technological innovations. Ready to discover what makes a mobile banking app truly exceptional? Let’s dive in.

The Evolution of Mobile Banking Technology

Before diving into our list of best mobile banking apps, it’s essential to understand the technological evolution that has shaped this sector. Initially, mobile banking applications offered rudimentary functionality, basic balance inquiries, and simple transaction histories.

However, advancements in cloud computing infrastructure, artificial intelligence algorithms, biometric authentication systems, and blockchain technology have collectively elevated these platforms into comprehensive financial management ecosystems.

Furthermore, the convergence of mobile app development best practices with financial services expertise has created a new paradigm where user-centric design principles meet enterprise-grade security requirements.

This intersection has produced applications that not only facilitate transactional activities but also provide predictive analytics, personalized financial advice, and integrated investment capabilities.

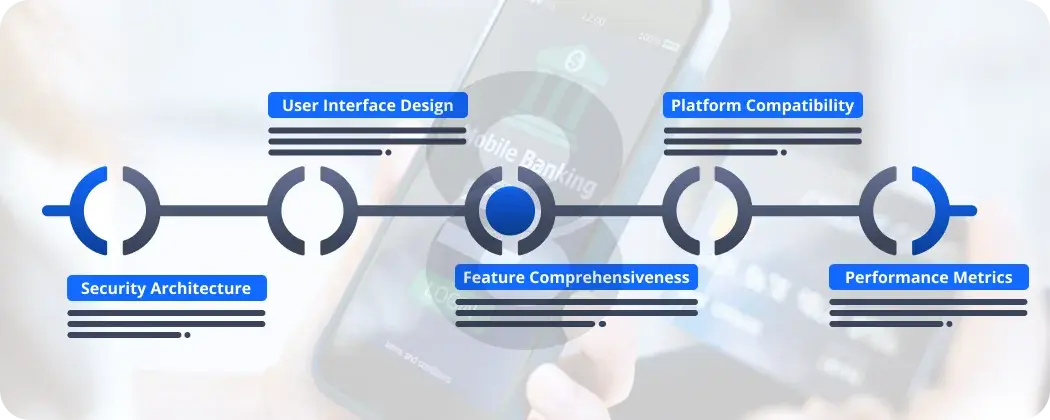

Criteria for Evaluating Top Mobile Banking Apps

When assessing the top mobile banking apps, several critical evaluation parameters must be considered:

Security Architecture

Multi-factor authentication, biometric verification, end-to-end encryption, and fraud detection algorithms form the foundation of trustworthy mobile banking platforms. Additionally, compliance with regulatory frameworks such as PCI DSS, GDPR, and SOC 2 demonstrates institutional commitment to data protection.

User Interface Design

Intuitive navigation schemas, responsive design patterns, accessibility compliance (WCAG standards), and minimalist aesthetic principles contribute significantly to user adoption and retention metrics.

Feature Comprehensiveness

Beyond basic account management, superior applications incorporate bill payment automation, peer-to-peer transfer capabilities, mobile check deposit functionality, and integrated budgeting tools.

Platform Compatibility

Smooth performance across iOS and Android app development ecosystems ensures maximum market penetration and user accessibility.

Performance Metrics

Application load times, transaction processing speeds, offline functionality, and system uptime statistics directly impact user satisfaction scores.

As of the end of 2025, around 2.17 billion people globally used mobile banking – a 35% increase since 2020.

Top 12 Best Mobile Banking Apps to Inspire Your Fintech Solution

Below is a comprehensive breakdown of industry-leading applications that dominate the market due to performance, UX, security, innovation, and financial management capabilities.

1. Chime: The Modern Banking Experience

Chime disrupts traditional banking with zero fees and instant notifications that keep you in control. Built for the digital generation, it combines simplicity with smart automation, making saving money effortless while delivering lightning-fast access to your paycheck.

Key Features

- Fee-Free Banking: No monthly fees, overdraft charges, or hidden costs

- Early Direct Deposit: Get paid up to 2 days early automatically

- Automatic Savings: Round-up purchases and save without thinking

2. Revolut: Global Payments and Multi-Currency Excellence

Travel the world without currency headaches. Revolut transforms international banking with real-time exchange rates across 150+ currencies, crypto trading, and stock investing, all in one sleek app that eliminates expensive foreign transaction fees.

Key Features

- Multi-Currency Accounts: Hold and exchange 150+ currencies instantly

- Crypto & Stocks Trading: Invest in Bitcoin, stocks, and commodities smoothly

- Disposable Virtual Cards: Generate one-time cards for maximum security

3. N26: Sleek European Digital Banking

Experience banking at the speed of life. N26’s award-winning minimalist design delivers instant account setup, crystal-clear spending insights, and bank-level security, all without the bureaucracy. It’s banking that actually understands modern lifestyles.

Key Features

- 5-Minute Account Opening: Sign up and start banking instantly

- Real-Time Spending Analytics: Visual insights categorize every transaction automatically

- Spaces Sub-Accounts: Create separate savings goals with custom rules

4. Monzo: Community-Driven Digital Bank

Banking with personality. Monzo turns mundane finances into an engaging experience with hot coral cards, instant notifications, and community-powered features. Split bills with friends, track spending in real-time, and join millions who’ve ditched traditional banks.

Key Features

- Instant Spending Notifications: Know exactly where your money goes immediately.

- Pots for Goals: Create multiple savings pots with personalized targets

- Bill Splitting Made Easy: Share expenses with friends smoothly

5. Ally Bank: A Leader in Online-Only Banking

Ditch the branches, keep the benefits. Ally delivers industry-leading interest rates, zero fees, and robust budgeting tools through a purely digital experience. With 24/7 customer service and comprehensive features, it proves that online-only doesn’t mean less service.

Key Features

- High-Yield Savings: Competitive interest rates with no minimum balance

- Smart Budgeting Tools: Track spending and set financial goals effortlessly

- No Monthly Fees: Complete banking without hidden charges

6. Capital One Mobile: Strong Security and Ease of Use

Security meets simplicity. Capital One combines military-grade encryption with intuitive design, offering instant card controls, AI-powered fraud detection, and smart spending insights. Lock your card with one tap and shop online worry-free with virtual card numbers.

Key Features

- Instant Card Lock/Unlock: Control your card security in real-time

- Virtual Card Numbers: Generate temporary cards for online purchases

- Eno AI Assistant: Get proactive fraud alerts and spending insights

7. Chase Mobile: Enterprise-Grade Features with Intuitive UX

Banking powerhouse meets elegant simplicity. Chase Mobile combines enterprise-level infrastructure with consumer-friendly design, delivering Zelle instant transfers, credit monitoring, and investment tools. Millions trust it daily for its reliability and comprehensive financial ecosystem.

Key Features

- Zelle Integration: Send money instantly to friends and family

- Credit Journey Monitoring: Track your credit score for free

- Unified Investment Access: Manage banking and investments in one place

8. Wells Fargo Mobile: Powerful Multi-Service Ecosystem

One app, endless possibilities. Wells Fargo’s comprehensive platform smoothly integrates checking, savings, credit cards, mortgages, and investments. Customize your dashboard, manage complex finances effortlessly, and access everything from bill pay to wealth management instantly.

Key Features

- Customizable Dashboard: Personalize your view of accounts and services

- Multi-Product Integration: Manage banking, loans, and investments together

- Advanced Security Controls: Biometric login with granular access settings

9. SoFi: Banking + Finance + Investments

Your complete financial life, one intelligent app. SoFi eliminates the need for multiple platforms by combining high-yield checking, automated investing, personal loans, and career coaching. It’s not just banking; it’s your financial co-pilot for building wealth.

Key Features

- High-Yield Checking & Savings: Earn competitive rates on everyday accounts

- Automated Investing: Build wealth with robo-advisor technology

- Free Credit Monitoring: Track your score and get personalized tips

10. Cash App: Payments + Banking in One Platform

Social meets financial. Cash App revolutionizes peer-to-peer payments with instant transfers, Bitcoin trading, and direct deposit, all wrapped in a beautifully simple interface. Send money like sending a text, invest spare change, and bank without traditional banking hassles.

Key Features

- Free P2P Payments: Send money instantly with zero fees

- Bitcoin Trading: Buy, sell, and hold crypto directly

- Cash Card Debit: Spend your balance anywhere with instant discounts

11. Varo: A Fully Digital, Regulated Bank

Real banking without the bank. Varo earned its national bank charter by delivering genuine value: no-fee overdraft protection, early paycheck access, and intelligent savings that grow automatically. It’s modern banking built on trust, transparency, and cutting-edge technology.

Key Features

- No-Fee Overdraft: Access up to $250 without penalties

- Get Paid Early: Receive paychecks up to 2 days early

- Auto-Save Function: Build savings effortlessly with smart automation

12. PayPal: Banking Meets Global eCommerce

PayPal smoothly blends digital banking capabilities with world-leading eCommerce payment infrastructure, enabling individuals and businesses to send, receive, store, and manage funds across borders with speed, reliability, and enterprise-grade security while supporting millions of merchants worldwide.

Key Strengths

- Worldwide acceptance

- Quick transfers

- Secure ecosystem

It remains one of the most influential financial apps globally.

What Users Look for in the Best Mobile Banking Apps Today

Modern users expect fast payments, transparent fees, advanced security, and simple budgeting tools. The table below compares essential features shaping user decisions across leading mobile banking apps.

# |

App Name |

Fees |

Security Level |

Budgeting Tools |

Global Transfers |

Platform Availability |

Unique Strength |

| 1 | Chime | No fees | High (biometric + alerts) | Yes | Limited | iOS & Android | Early direct deposit |

| 2 | Revolut | Low fees | High (disposable cards) | Yes | Excellent | iOS & Android | Multi-currency support |

| 3 | N26 | Low fees | High | Yes | Moderate | iOS & Android | Minimalist UX |

| 4 | Monzo | Low fees | High | Yes | Moderate | iOS & Android | Community-driven features |

| 5 | Ally Bank | No fees | High | Strong | No | iOS & Android | High-yield savings |

| 6 | Capital One | Low fees | Very High | Moderate | No | iOS & Android | Advanced fraud monitoring |

| 7 | Chase Mobile | Standard fees | High | Moderate | Yes | iOS & Android | Zelle integration |

| 8 | SoFi | No fees | High | Strong | Limited | iOS & Android | Banking + investments |

| 9 | Cash App | Free basic use | High | Limited | No | iOS & Android | Fast P2P payments |

| 10 | PayPal | Low fees | High | Limited | Excellent | iOS & Android | Global payments ecosystem |

Development Considerations for Fintech Solutions

For organizations embarking on fintech app development, several critical considerations emerge from analyzing industry leaders:

Security-First Architecture

Implementing defense-in-depth strategies, including application-layer encryption, secure API gateways, and runtime application self-protection (RASP) technologies, establishes foundational trust with users.

Regulatory Compliance

Navigating complex regulatory environments requires expertise in banking regulations, data protection laws, and consumer financial protection statutes. Engaging compliance specialists during architecture design prevents costly retrofitting.

Scalable Infrastructure

Cloud-native architectures leveraging containerization, microservices, and serverless computing enable elastic scalability while optimizing operational costs.

Cross-Platform Development

Balancing native performance advantages against development efficiency requires strategic technology selection. Frameworks like React Native or Flutter offer compelling compromises for resource-constrained teams.

API-First Design

Exposing banking functionality through well-documented, versioned APIs facilitates partner integrations, third-party service connections, and future platform extensibility.

User Experience Research

Continuous usability testing, A/B experimentation, and behavioral analytics inform iterative improvements that enhance adoption and retention metrics.

The Future of Mobile Banking Applications

The trajectory of best mobile banking apps points toward several emerging technological integrations:

- Artificial Intelligence: Advanced machine learning models will provide increasingly sophisticated fraud detection, personalized financial advice, and predictive cash flow management.

- Blockchain Integration: Distributed ledger technologies promise enhanced transaction transparency, reduced settlement times, and novel financial instrument accessibility.

- Open Banking APIs: Regulatory mandates for API-based data sharing will enable third-party financial services integration, creating comprehensive financial management ecosystems.

- Voice-First Interfaces: Natural language processing advancements will make voice-activated banking increasingly practical for routine transactions and account inquiries.

- Augmented Reality: AR technologies may transform how users visualize spending patterns, navigate financial data, and interact with physical banking locations.

- Quantum-Resistant Cryptography: As quantum computing capabilities advance, banking applications must adopt post-quantum cryptographic algorithms to maintain long-term security assurances.

Mobile Banking App Security Best Practices

The mobile banking app comparison across security implementations reveals essential protective measures:

- Multi-Factor Authentication: Combining knowledge factors (passwords), possession factors (device verification), and inherence factors (biometrics) significantly reduces unauthorized access risks.

- Certificate Pinning: Hardcoding expected server certificates within mobile applications prevents man-in-the-middle attacks through rogue certificate authorities.

- Jailbreak/Root Detection: Identifying compromised devices enables applications to restrict functionality or deny access entirely when operating system integrity is questionable.

- Code Obfuscation: Protecting application logic through obfuscation techniques increases the difficulty for reverse engineering attempts seeking to identify vulnerabilities.

- Session Management: Implementing aggressive timeout policies, secure token storage, and proper session invalidation prevents unauthorized access through abandoned devices.

How 8ration Helps You Build Future-Ready Mobile Banking Apps

At 8ration, we specialize in crafting high-performance fintech solutions that match, and even surpass, the innovation seen in the current leading digital banks. Our team blends deep industry expertise with advanced mobile app development practices, including secure architectures, smooth user journeys, API-driven banking features, and compliance-focused workflows.

Whether you’re building next-gen digital banking apps, budgeting tools, or global payment solutions, we ensure scalability, security, and an unmatched user experience. With end-to-end capabilities across Android and iOS app development, 8ration transforms your fintech vision into a robust, market-ready product built for long-term success.

“We believe that the true power of digital banking lies in seamless UX, iron-clad security, and intelligent automation, which is why our fintech app development focuses on innovative yet user-centric design.”

– Muzamil Liaqut Rao, CEO at 8ration

Final Thoughts!

In conclusion, evaluating this comprehensive list of best mobile banking apps gives fintech teams the foundation they need to design innovative, user-centric banking experiences. The apps featured in this article, from Chime and Revolut to PayPal and N26, represent the gold standard of digital banking excellence.

By analyzing their features, UX strategies, and security measures, you gain insights to develop banking apps that outperform competitors. Whether you are focusing on Fintech app development or platform-specific technologies such as Android or iOS app development, this list of best mobile banking apps will serve as a blueprint for building robust, secure, and modern financial solutions.